|

|

Pope: Not to share wealth with poor is to steal

Seraph.Ramyrez Seraph.Ramyrez

Server: Seraph

Game: FFXI

Posts: 1918

By Seraph.Ramyrez 2015-04-29 12:05:12

Get the Pope some poor children and a sappy song then watch the money roll in !

Getting some little kids for a Catholic authority figure?

What could possibly go wrong?!

[+]

Asura.Saevel Asura.Saevel

Server: Asura

Game: FFXI

Posts: 9733

By Asura.Saevel 2015-04-29 20:11:44

I really think that these things don't occur to many, many people. At least not really. They'll say they do and argue passionately that they're right even with these factors figured in. If they've put hard work in, they're loathe to admit that anything else played a factor in their success. Not loathing to admit anything, it doesn't factor into the equation.

Or are we supposed to sing praises for the people who make the programs we use to succeed, or the pencil makers for making the pencil that was in our workpapers that helped us succeed?

If their arguments seem to irrational it's because they are. The reason for their arguments to exist is to reinforce their belief that since your not 100% responsible for your success then they are entitled to take from the fruits of your success. They aren't trying to explain something or debate a point but instead are justifying their decision to steal from the success of others. It's an emotional argument and should be ignored and discarded because you don't fight emotional arguments with rational ones.

VIP

Server: Odin

Game: FFXI

Posts: 9534

By Odin.Jassik 2015-04-29 20:17:39

I really think that these things don't occur to many, many people. At least not really. They'll say they do and argue passionately that they're right even with these factors figured in. If they've put hard work in, they're loathe to admit that anything else played a factor in their success. Not loathing to admit anything, it doesn't factor into the equation.

Or are we supposed to sing praises for the people who make the programs we use to succeed, or the pencil makers for making the pencil that was in our workpapers that helped us succeed?

If their arguments seem to irrational it's because they are. The reason for their arguments to exist is to reinforce their belief that since your not 100% responsible for your success then they are entitled to take from the fruits of your success. They aren't trying to explain something or debate a point but instead are justifying their decision to steal from the success of others. It's an emotional argument and should be ignored and discarded because you don't fight emotional arguments with rational ones.

Did it ever occur to you that the lower class could get affordable education and be successful without stealing from the people who worked for success already? The poor can be in plight they didn't create without it affecting the middle and upper classes.

[+]

By Zackan 2015-04-30 01:42:10

So I have the ultimate solution to fixing Social Security, without repealing it.

By Zackan 2015-04-30 01:51:11

August 14, 1935, Austin, TX

Social Security Administration, Founded

source https://en.wikipedia.org/wiki/Social_Security_Administration

Some interesting notes

Back in 1935 the the age expectancy was

1935 61.7

source http://www.infoplease.com/ipa/A0005148.html

in 2015 the age expectancy is

2015 82.19

source http://www.data360.org/dsg.aspx?Data_Set_Group_Id=195

So what does this tell us...

it tells us the Social Security Age requirement is three years HIGHER than the age expectancy back in 1935

NOW the age requirement is 17 years HIGHER than the social security age requirement.

The Solution: Raise the age requirement to 85 , and anytime the average expectancy raises.. raise the age requirement as well.

By fonewear 2015-04-30 08:13:45

I really think that these things don't occur to many, many people. At least not really. They'll say they do and argue passionately that they're right even with these factors figured in. If they've put hard work in, they're loathe to admit that anything else played a factor in their success. Not loathing to admit anything, it doesn't factor into the equation.

Or are we supposed to sing praises for the people who make the programs we use to succeed, or the pencil makers for making the pencil that was in our workpapers that helped us succeed?

If their arguments seem to irrational it's because they are. The reason for their arguments to exist is to reinforce their belief that since your not 100% responsible for your success then they are entitled to take from the fruits of your success. They aren't trying to explain something or debate a point but instead are justifying their decision to steal from the success of others. It's an emotional argument and should be ignored and discarded because you don't fight emotional arguments with rational ones.

You don't feel as much as I feel about the poor !

[+]

Asura.Saevel Asura.Saevel

Server: Asura

Game: FFXI

Posts: 9733

By Asura.Saevel 2015-04-30 20:46:34

I really think that these things don't occur to many, many people. At least not really. They'll say they do and argue passionately that they're right even with these factors figured in. If they've put hard work in, they're loathe to admit that anything else played a factor in their success. Not loathing to admit anything, it doesn't factor into the equation.

Or are we supposed to sing praises for the people who make the programs we use to succeed, or the pencil makers for making the pencil that was in our workpapers that helped us succeed?

If their arguments seem to irrational it's because they are. The reason for their arguments to exist is to reinforce their belief that since your not 100% responsible for your success then they are entitled to take from the fruits of your success. They aren't trying to explain something or debate a point but instead are justifying their decision to steal from the success of others. It's an emotional argument and should be ignored and discarded because you don't fight emotional arguments with rational ones.

You don't feel as much as I feel about the poor !

But I'm more oppressed then you so my feelings matter more. Why do you want to hurt the feelings of all those starving kids in Africa, look at them they are so hungry.

[+]

By Zackan 2015-04-30 21:04:03

I really think that these things don't occur to many, many people. At least not really. They'll say they do and argue passionately that they're right even with these factors figured in. If they've put hard work in, they're loathe to admit that anything else played a factor in their success. Not loathing to admit anything, it doesn't factor into the equation.

Or are we supposed to sing praises for the people who make the programs we use to succeed, or the pencil makers for making the pencil that was in our workpapers that helped us succeed?

If their arguments seem to irrational it's because they are. The reason for their arguments to exist is to reinforce their belief that since your not 100% responsible for your success then they are entitled to take from the fruits of your success. They aren't trying to explain something or debate a point but instead are justifying their decision to steal from the success of others. It's an emotional argument and should be ignored and discarded because you don't fight emotional arguments with rational ones.

You don't feel as much as I feel about the poor !

But I'm more oppressed then you so my feelings matter more. Why do you want to hurt the feelings of all those starving kids in Africa, look at them they are so hungry.

give them smoothie machines.. they will be good

Bahamut.Ravael Bahamut.Ravael

Server: Bahamut

Game: FFXI

Posts: 13622

By Bahamut.Ravael 2015-04-30 21:07:25

A reliable source told me that the only water flowing in Africa is the bitter sting of tears.

[+]

VIP

Server: Odin

Game: FFXI

Posts: 9534

By Odin.Jassik 2015-04-30 21:10:43

Right, employers already won't touch someone over 60, let's force them to work another 20 years. Did it occur to you that executives have a lower effective tax rate than most of their employees or that executive salaries have risen 4-500% adjusted for inflation in just the last 30 years while middle class incomes have risen less than 60%? Might it make sense for them to pay the same effective tax rates to help pay for all the benefits they are also entitled to even if they don't need them? People who don't drive are still paying for roads, people who don't receive welfare are still paying for it, why should anyone not?

Leviathan.Protey Leviathan.Protey

Server: Leviathan

Game: FFXI

Posts: 685

By Leviathan.Protey 2015-04-30 23:03:49

where are you getting that executives have a lower effective tax rate than their employees? Last I checked, the more you make, the higher tax bracket you are in. And since they are executives that means they are not the owner of the business and so can't write off the expenses of the business.

[+]

VIP

Server: Odin

Game: FFXI

Posts: 9534

By Odin.Jassik 2015-04-30 23:46:01

where are you getting that executives have a lower effective tax rate than their employees? Last I checked, the more you make, the higher tax bracket you are in. And since they are executives that means they are not the owner of the business and so can't write off the expenses of the business.

Effective tax rate is the rate you pay of your gross income in relation to your adjusted income. Here's the rub: Executives average yearly salary is hovering just below 12 million dollars. The progressive tax rates cap at ~450K. That's just their cash salary. A very large portion of an executive's compensation packages (some as much as 75% of total compensation) can include stock options (ISO) that are taxed at a much lower rate. And, the real value of those options once exercised is their appreciation, which is taxed at the capital gains rates.

This does a decent job of explaining how effective tax rates are determined. Tax people will tell you that exercising your deductions is what you're supposed to do, and that everyone is entitled to the same deductions, which is true. But, TP neo-cons will say in the same breath that the EITC is a scam, which makes no sense, and that the rich pay most of the taxes, which is dishonest. 10% of the population gets almost 90% of new income but pay only about 34% of the total taxes, that's 90% of private income generating only slightly more tax revenue than the 10% earned by everyone else.

That's just income, accrued wealth accounts for another significant chunk of money that isn't being taxed at the same rate on both ends. I'm not saying tax the rich more, just stop pretending they're getting the brown end of the lollipop.

By Zackan 2015-05-01 00:00:15

where are you getting that executives have a lower effective tax rate than their employees? Last I checked, the more you make, the higher tax bracket you are in. And since they are executives that means they are not the owner of the business and so can't write off the expenses of the business.

Effective tax rate is the rate you pay of your gross income in relation to your adjusted income. Here's the rub: Executives average yearly salary is hovering just below 12 million dollars. The progressive tax rates cap at ~450K. That's just their cash salary. A very large portion of an executive's compensation packages (some as much as 75% of total compensation) can include stock options (ISO) that are taxed at a much lower rate. And, the real value of those options once exercised is their appreciation, which is taxed at the capital gains rates.

This does a decent job of explaining how effective tax rates are determined. Tax people will tell you that exercising you deductions is what you're supposed to do, and that everyone is entitled to the same deductions, which is true. But, TP neo-cons will say in the same breath that the EITC is a scam, which makes no sense, and that the rich pay most of the taxes, which is dishonest. 10% of the population gets almost 90% of new income but pay only about 34% of the total taxes, that's 90% of private income generating only slightly more tax revenue than the 10% earned by everyone else.

That's just income, accrued wealth accounts for another significant chunk of money that isn't being taxed at the same rate on both ends. I'm not saying tax the rich more, just stop pretending they're getting the brown end of the lollipop.

Basically the rich know all the loopholes to reduce there taxes,

Corporations are indeed evil, they do lobbying and invest alot of money into money people so they don't have to pay the taxes.

Right, employers already won't touch someone over 60, let's force them to work another 20 years. Did it occur to you that executives have a lower effective tax rate than most of their employees or that executive salaries have risen 4-500% adjusted for inflation in just the last 30 years while middle class incomes have risen less than 60%? Might it make sense for them to pay the same effective tax rates to help pay for all the benefits they are also entitled to even if they don't need them? People who don't drive are still paying for roads, people who don't receive welfare are still paying for it, why should anyone not?

So what? Bottomline is age expectancy is the reason social security is broken. It is the reason why money is taken from non social security funds to support social security. There is literally no REAL PERMANENT(not counting repealing it all together) way to fix social security UNLESS you adjust age requirement with age expectancy.

Basically, health technology is screwing over our social security program.

Back in 1935 the average person died at 62. If they 'don't touch' people after 60... then thats a 5 year gap. So change laws to require non age discrimination up to age 80.. change social security to age 65. problem fixed.

VIP

Server: Odin

Game: FFXI

Posts: 9534

By Odin.Jassik 2015-05-01 00:09:36

Basically the rich know all the loopholes to reduce there taxes,

Corporations are indeed evil, they do lobbying and invest alot of money into money people so they don't have to pay the taxes.

Not so much, it's not that they know the code or can afford better accountants, it's that, just like your SSI example, the goalposts have moved.

So what? Bottomline is age expectancy is the reason social security is broken. It is the reason why money is taken from non social security funds to support social security. There is literally no REAL PERMANENT(not counting repealing it all together) way to fix social security UNLESS you adjust age requirement with age expectancy.

Basically, health technology is screwing over our social security program.

Back in 1935 the average person died at 62. If they 'don't touch' people after 60... then thats a 5 year gap. So change laws to require non age discrimination up to age 80.. change social security to age 65. problem fixed.

Not saying I disagree, but a large portion of the SSI issue we currently face is the reduced revenue due to stagnant wage growth for the vast majority of earners, repetitive borrowing from the fund to cover budget shortfalls, and the significant bulge in the age demographics with the baby-boomers hitting retirement age. SSI requires a strong middle class and fairly flat age demographics to remain solvent. Increased life expectancy is just one factor, which most definitely does need to be addressed, but not by simply increasing retirement age to beyond life expectancy. I'm guessing you're nowhere near retirement age.

Leviathan.Protey Leviathan.Protey

Server: Leviathan

Game: FFXI

Posts: 685

By Leviathan.Protey 2015-05-01 00:56:27

where are you getting that executives have a lower effective tax rate than their employees? Last I checked, the more you make, the higher tax bracket you are in. And since they are executives that means they are not the owner of the business and so can't write off the expenses of the business.

Effective tax rate is the rate you pay of your gross income in relation to your adjusted income. Here's the rub: Executives average yearly salary is hovering just below 12 million dollars. The progressive tax rates cap at ~450K. That's just their cash salary. A very large portion of an executive's compensation packages (some as much as 75% of total compensation) can include stock options (ISO) that are taxed at a much lower rate. And, the real value of those options once exercised is their appreciation, which is taxed at the capital gains rates.

This does a decent job of explaining how effective tax rates are determined. Tax people will tell you that exercising your deductions is what you're supposed to do, and that everyone is entitled to the same deductions, which is true. But, TP neo-cons will say in the same breath that the EITC is a scam, which makes no sense, and that the rich pay most of the taxes, which is dishonest. 10% of the population gets almost 90% of new income but pay only about 34% of the total taxes, that's 90% of private income generating only slightly more tax revenue than the 10% earned by everyone else.

That's just income, accrued wealth accounts for another significant chunk of money that isn't being taxed at the same rate on both ends. I'm not saying tax the rich more, just stop pretending they're getting the brown end of the lollipop.

There is more than one definition of effective tax rate, the one I had in mind is:

Quote: Tax Brackets and Effective Tax Rates

If your marginal tax rate is, for example, 25%. That doesn't mean that ALL of your income is taxed at 25%. Income is actually taxed at different rates. Here's how it works:

Say that your income for 2014 is $40,000 and your filing status is single. Your first $9,075 will be taxed at 10%. Every dollar from $9,076 to $36,900 will be taxed at 15%. And every dollar from $36,900 to $40,000 will be taxed at 25%.

So, if you added up the taxes that you pay on each portion of your income, and then divide it by your total income (then multiply by 100), you would get your "effective tax rate". This is the actual rate you pay on your taxes, regardless of your marginal tax rate.

Also, the cap may be at ~450k, but it's still about 40% tax rate for anything over that amount, while the vast majority of other people are paying 15-25%. But I do acknowledge your argument about the stock options. Capital Gains tax rate caps at 15% iirc.

Cerberus.Logical Cerberus.Logical

Server: Cerberus

Game: FFXI

Posts: 76

By Cerberus.Logical 2015-05-01 01:36:54

where are you getting that executives have a lower effective tax rate than their employees? Last I checked, the more you make, the higher tax bracket you are in. And since they are executives that means they are not the owner of the business and so can't write off the expenses of the business.

Effective tax rate is the rate you pay of your gross income in relation to your adjusted income. Here's the rub: Executives average yearly salary is hovering just below 12 million dollars. The progressive tax rates cap at ~450K. That's just their cash salary. A very large portion of an executive's compensation packages (some as much as 75% of total compensation) can include stock options (ISO) that are taxed at a much lower rate. And, the real value of those options once exercised is their appreciation, which is taxed at the capital gains rates.

This does a decent job of explaining how effective tax rates are determined. Tax people will tell you that exercising your deductions is what you're supposed to do, and that everyone is entitled to the same deductions, which is true. But, TP neo-cons will say in the same breath that the EITC is a scam, which makes no sense, and that the rich pay most of the taxes, which is dishonest. 10% of the population gets almost 90% of new income but pay only about 34% of the total taxes, that's 90% of private income generating only slightly more tax revenue than the 10% earned by everyone else.

That's just income, accrued wealth accounts for another significant chunk of money that isn't being taxed at the same rate on both ends. I'm not saying tax the rich more, just stop pretending they're getting the brown end of the lollipop.

There is more than one definition of effective tax rate, the one I had in mind is:

Quote: Tax Brackets and Effective Tax Rates

If your marginal tax rate is, for example, 25%. That doesn't mean that ALL of your income is taxed at 25%. Income is actually taxed at different rates. Here's how it works:

Say that your income for 2014 is $40,000 and your filing status is single. Your first $9,075 will be taxed at 10%. Every dollar from $9,076 to $36,900 will be taxed at 15%. And every dollar from $36,900 to $40,000 will be taxed at 25%.

So, if you added up the taxes that you pay on each portion of your income, and then divide it by your total income (then multiply by 100), you would get your "effective tax rate". This is the actual rate you pay on your taxes, regardless of your marginal tax rate.

Also, the cap may be at ~450k, but it's still about 40% tax rate for anything over that amount, while the vast majority of other people are paying 15-25%. But I do acknowledge your argument about the stock options. Capital Gains tax rate caps at 15% iirc.

Capital gains rates used to cap at 15%. Now, under 26 U.S.C. 1(h), the highest maximum capital gains rate is 20%. On top of that, Obamacare imposes a 3.8% medicare surtax on capital gains, which places the top-end maximum capital gains rates at 23.8%.

Also, the bit above providing an illustration of the Section 1 tax ladder is helpful for those unfamiliar. It's a scaling ladder, not a flat rate.

Quote: Basically the rich know all the loopholes to reduce there taxes,

Corporations are indeed evil, they do lobbying and invest alot of money into money people so they don't have to pay the taxes.

I would like to add some input here. When you refer to "corporations," you are picturing large, publicly-traded Corporations incorporated under Subchapter C. A majority of Corporations (again, not taking into consideration market share or revenue, just a numerical count), are S-Corps and smaller C-Corps. These closely held Corporations are entities which are typically run by families or business partners who have banded together under the Corporate banner for the insulation from liability which the Corporate form offers them. Point is, you mustn't harbor animosity towards all Corporate entities - a majority of incorporated business is actually small business owned by close and personal shareholders. The image of a disinterested, steely and evil public corporation is misapplied to not only all other forms of incorporation, but to much of management in the world of commerce. The only companies with the kind of lobbying power and clout which you have described are, by and far, the minority.

[+]

By Zackan 2015-05-01 02:57:29

where are you getting that executives have a lower effective tax rate than their employees? Last I checked, the more you make, the higher tax bracket you are in. And since they are executives that means they are not the owner of the business and so can't write off the expenses of the business.

Effective tax rate is the rate you pay of your gross income in relation to your adjusted income. Here's the rub: Executives average yearly salary is hovering just below 12 million dollars. The progressive tax rates cap at ~450K. That's just their cash salary. A very large portion of an executive's compensation packages (some as much as 75% of total compensation) can include stock options (ISO) that are taxed at a much lower rate. And, the real value of those options once exercised is their appreciation, which is taxed at the capital gains rates.

This does a decent job of explaining how effective tax rates are determined. Tax people will tell you that exercising your deductions is what you're supposed to do, and that everyone is entitled to the same deductions, which is true. But, TP neo-cons will say in the same breath that the EITC is a scam, which makes no sense, and that the rich pay most of the taxes, which is dishonest. 10% of the population gets almost 90% of new income but pay only about 34% of the total taxes, that's 90% of private income generating only slightly more tax revenue than the 10% earned by everyone else.

That's just income, accrued wealth accounts for another significant chunk of money that isn't being taxed at the same rate on both ends. I'm not saying tax the rich more, just stop pretending they're getting the brown end of the lollipop.

There is more than one definition of effective tax rate, the one I had in mind is:

Quote: Tax Brackets and Effective Tax Rates

If your marginal tax rate is, for example, 25%. That doesn't mean that ALL of your income is taxed at 25%. Income is actually taxed at different rates. Here's how it works:

Say that your income for 2014 is $40,000 and your filing status is single. Your first $9,075 will be taxed at 10%. Every dollar from $9,076 to $36,900 will be taxed at 15%. And every dollar from $36,900 to $40,000 will be taxed at 25%.

So, if you added up the taxes that you pay on each portion of your income, and then divide it by your total income (then multiply by 100), you would get your "effective tax rate". This is the actual rate you pay on your taxes, regardless of your marginal tax rate.

Also, the cap may be at ~450k, but it's still about 40% tax rate for anything over that amount, while the vast majority of other people are paying 15-25%. But I do acknowledge your argument about the stock options. Capital Gains tax rate caps at 15% iirc.

Capital gains rates used to cap at 15%. Now, under 26 U.S.C. 1(h), the highest maximum capital gains rate is 20%. On top of that, Obamacare imposes a 3.8% medicare surtax on capital gains, which places the top-end maximum capital gains rates at 23.8%.

Also, the bit above providing an illustration of the Section 1 tax ladder is helpful for those unfamiliar. It's a scaling ladder, not a flat rate.

Quote: Basically the rich know all the loopholes to reduce there taxes,

Corporations are indeed evil, they do lobbying and invest alot of money into money people so they don't have to pay the taxes.

I would like to add some input here. When you refer to "corporations," you are picturing large, publicly-traded Corporations incorporated under Subchapter C. A majority of Corporations (again, not taking into consideration market share or revenue, just a numerical count), are S-Corps and smaller C-Corps. These closely held Corporations are entities which are typically run by families or business partners who have banded together under the Corporate banner for the insulation from liability which the Corporate form offers them. Point is, you mustn't harbor animosity towards all Corporate entities - a majority of incorporated business is actually small business owned by close and personal shareholders. The image of a disinterested, steely and evil public corporation is misapplied to not only all other forms of incorporation, but to much of management in the world of commerce. The only companies with the kind of lobbying power and clout which you have described are, by and far, the minority.

Point taken, So how do i say corporations like google and other big corporations are 'the root of all evil' since i do not want to mistakenly lump smaller companies into that

So what? Bottomline is age expectancy is the reason social security is broken. It is the reason why money is taken from non social security funds to support social security. There is literally no REAL PERMANENT(not counting repealing it all together) way to fix social security UNLESS you adjust age requirement with age expectancy.

Basically, health technology is screwing over our social security program.

Back in 1935 the average person died at 62. If they 'don't touch' people after 60... then thats a 5 year gap. So change laws to require non age discrimination up to age 80.. change social security to age 65. problem fixed.

Not saying I disagree, but a large portion of the SSI issue we currently face is the reduced revenue due to stagnant wage growth for the vast majority of earners, repetitive borrowing from the fund to cover budget shortfalls, and the significant bulge in the age demographics with the baby-boomers hitting retirement age. SSI requires a strong middle class and fairly flat age demographics to remain solvent. Increased life expectancy is just one factor, which most definitely does need to be addressed, but not by simply increasing retirement age to beyond life expectancy. I'm guessing you're nowhere near retirement age.

Nah I am not. FYI i am 60% joking here.

Just making a pure logic argument is all.

If Age expectancy was 62 at foundation with a required age of 65... then logic dictates that in order for it to work as designed if age expectancy is now 82... then required age needs to be 85^^

Simple logic argument thats all..(overly simplistic as well, but i dont mind! making this argument lightheartedly anyway)

Server: Asura

Game: FFXI

Posts: 34187

By Asura.Kingnobody 2015-05-01 07:29:10

Executives average yearly salary is hovering just below 12 million dollars. A very large portion of an executive's compensation packages (some as much as 75% of total compensation) can include stock options (ISO) that are taxed at a much lower rate. . Executive stock options are generally non-statutory stock options, and are taxable as compensation on the year it is received (included in Boxes 1,3,5 of their W-2, and Box 12 has a code "V" on it showing how much of the compensation is stock options). The reason why they are non-statutory stock options is that they are granted in lieu of wages, and are subject to ordinary rates. And guess what, when they sell those stock, they are taxed again at capital gains rate.

that the rich pay most of the taxes, which is dishonest. . And the Tax Foundation is hardly a non-partisan source when it comes to taxing the rich.

10% of the population gets almost 90% of new income but pay only about 34% of the total taxes, that's 90% of private income generating only slightly more tax revenue than the 10% earned by everyone else. Wrong again, see the above link for evidence showing how full of ***you are.

That's just income, accrued wealth accounts for another significant chunk of money that isn't being taxed at the same rate on both ends. Accrued wealth is already taxed wealth. But I'm sure you are all for taxing that wealth again. That is, until you realize that the same tax that is taxing the wealth is also draining what little savings anyone has (taxes cannot discriminate, when you set a tax to tax one group of people, you tax everyone, it is against the constitution to create a tax only one group of people would pay). So, let's go ahead and tax wealth, and watch poverty rates soar because of it!

Server: Asura

Game: FFXI

Posts: 34187

By Asura.Kingnobody 2015-05-01 07:29:47

where are you getting that executives have a lower effective tax rate than their employees? Last I checked, the more you make, the higher tax bracket you are in. And since they are executives that means they are not the owner of the business and so can't write off the expenses of the business.

Effective tax rate is the rate you pay of your gross income in relation to your adjusted income. Here's the rub: Executives average yearly salary is hovering just below 12 million dollars. The progressive tax rates cap at ~450K. That's just their cash salary. A very large portion of an executive's compensation packages (some as much as 75% of total compensation) can include stock options (ISO) that are taxed at a much lower rate. And, the real value of those options once exercised is their appreciation, which is taxed at the capital gains rates.

This does a decent job of explaining how effective tax rates are determined. Tax people will tell you that exercising your deductions is what you're supposed to do, and that everyone is entitled to the same deductions, which is true. But, TP neo-cons will say in the same breath that the EITC is a scam, which makes no sense, and that the rich pay most of the taxes, which is dishonest. 10% of the population gets almost 90% of new income but pay only about 34% of the total taxes, that's 90% of private income generating only slightly more tax revenue than the 10% earned by everyone else.

That's just income, accrued wealth accounts for another significant chunk of money that isn't being taxed at the same rate on both ends. I'm not saying tax the rich more, just stop pretending they're getting the brown end of the lollipop.

There is more than one definition of effective tax rate, the one I had in mind is:

Quote: Tax Brackets and Effective Tax Rates

If your marginal tax rate is, for example, 25%. That doesn't mean that ALL of your income is taxed at 25%. Income is actually taxed at different rates. Here's how it works:

Say that your income for 2014 is $40,000 and your filing status is single. Your first $9,075 will be taxed at 10%. Every dollar from $9,076 to $36,900 will be taxed at 15%. And every dollar from $36,900 to $40,000 will be taxed at 25%.

So, if you added up the taxes that you pay on each portion of your income, and then divide it by your total income (then multiply by 100), you would get your "effective tax rate". This is the actual rate you pay on your taxes, regardless of your marginal tax rate.

Also, the cap may be at ~450k, but it's still about 40% tax rate for anything over that amount, while the vast majority of other people are paying 15-25%. But I do acknowledge your argument about the stock options. Capital Gains tax rate caps at 15% iirc.

Capital gains rates used to cap at 15%. Now, under 26 U.S.C. 1(h), the highest maximum capital gains rate is 20%. On top of that, Obamacare imposes a 3.8% medicare surtax on capital gains, which places the top-end maximum capital gains rates at 23.8%.

Also, the bit above providing an illustration of the Section 1 tax ladder is helpful for those unfamiliar. It's a scaling ladder, not a flat rate.

Quote: Basically the rich know all the loopholes to reduce there taxes,

Corporations are indeed evil, they do lobbying and invest alot of money into money people so they don't have to pay the taxes.

I would like to add some input here. When you refer to "corporations," you are picturing large, publicly-traded Corporations incorporated under Subchapter C. A majority of Corporations (again, not taking into consideration market share or revenue, just a numerical count), are S-Corps and smaller C-Corps. These closely held Corporations are entities which are typically run by families or business partners who have banded together under the Corporate banner for the insulation from liability which the Corporate form offers them. Point is, you mustn't harbor animosity towards all Corporate entities - a majority of incorporated business is actually small business owned by close and personal shareholders. The image of a disinterested, steely and evil public corporation is misapplied to not only all other forms of incorporation, but to much of management in the world of commerce. The only companies with the kind of lobbying power and clout which you have described are, by and far, the minority. Finally, somebody else who knows what they are talking about when it comes to the IRC.

I knew that I wasn't the only one here who knows about taxes.

[+]

Server: Asura

Game: FFXI

Posts: 34187

By Asura.Kingnobody 2015-05-01 07:34:43

I would like to add some input here. When you refer to "corporations," you are picturing large, publicly-traded Corporations incorporated under Subchapter C. A majority of Corporations (again, not taking into consideration market share or revenue, just a numerical count), are S-Corps and smaller C-Corps. These closely held Corporations are entities which are typically run by families or business partners who have banded together under the Corporate banner for the insulation from liability which the Corporate form offers them. Point is, you mustn't harbor animosity towards all Corporate entities - a majority of incorporated business is actually small business owned by close and personal shareholders. The image of a disinterested, steely and evil public corporation is misapplied to not only all other forms of incorporation, but to much of management in the world of commerce. The only companies with the kind of lobbying power and clout which you have described are, by and far, the minority. Also, a good portion (growing portion) of "corporations" in the eyes of the federal government are actually classified as "Limited Liability Companies."

Another thing to consider that all Subchapter "S" Corporations, Limited Liability Companies, and Partnerships are not taxed at the lower Corporate Tax Rate, but at the much higher Individual Tax Rate because the income made by these companies (well over 95% of all businesses in the US are businesses organized other than Subchapter "C" Corporations) have their taxable income passed through to the owners, and the owners themselves pay the taxes. In some cases, all of the taxable income is passed to one owner (Single Owner S-Corps and Single Member LLCs).

[+]

By volkom 2015-05-01 08:12:50

A reliable source told me that the only water flowing in Africa is the bitter sting of tears.

for some reason this came to mind

YouTube Video Placeholder

[+]

VIP

Server: Odin

Game: FFXI

Posts: 9534

By Odin.Jassik 2015-05-01 10:38:18

Where in the *** did you get your number from, your ***?

My number is from the SEC, Fortune 500 CEO's. All corporations have a CEO, even very small privately owned corporations. We're not talking about a family bakery, we're talking about publicly traded corporations. Including small business owner/executives is the equivalent of including fake Rolex's in an average price of Rolex's statistic.

And, for the record, your figure is based on voluntary information for ALL corporations, not just publicly traded ones.

Wrong again. Executive stock options are generally non-statutory stock options, and are taxable as compensation on the year it is received

No, just no. You can't H&R *** canon on this. Most non-executive stock compensation are non-statutory unless they're part of a buying program, executives are almost always given ISO's, which often cannot be exercised for years, so their actual value is taxed as capital gains and not income. You know better. Basically, they're paid a dollar which they cannot spend, it's taxed as a dollar, then 2 years later they can spend it, only now it's 12 dollars, and it's taxed as capital gains. The majority of it's actual value is not considered income. It's a "legitimate" tax code that everyone has access to, except the 99.9% of the population that doesn't get ISO's...

Spreading lies like you do is dishonest. And the Tax Foundation is hardly a non-partisan source when it comes to taxing the rich.

If you focus solely on INDIVIDUAL INCOME TAXES, which is why I said it's dishonest. Individual income taxes make up less than 40% of total taxes paid. When compared to the whole, the difference is the top 10% paying roughly 22% of total taxes and the other 90% paying about 18%. Even if we used your graph, why is 90% of the income only responsible for 68% of the taxes?

Also, on the topic of The Tax Foundation and their bias. Do you find it odd that most of their current and previous directors were executives of energy conglomerates? (Koch, Exxon Mobile, BP) or maybe that just about all the rest were former Republican congressmen? It's a conservative think-tank, and their practices have come under scrutiny repeatedly in the last several decades, often drawing the ire of even right-leaning watchdog groups.

Accrued wealth is already taxed wealth. But I'm sure you are all for taxing that wealth again. That is, until you realize that the same tax that is taxing the wealth is also draining what little savings anyone has (taxes cannot discriminate, when you set a tax to tax one group of people, you tax everyone, it is against the constitution to create a tax only one group of people would pay). So, let's go ahead and tax wealth, and watch poverty rates soar because of it!

I'm not talking about the family farm, I'm talking about investments, which are commonly held abroad by wealthy people. Foreign holdings are treated differently than domestic, especially when their value appreciates.

And, once again, I haven't advocated taxing accrued wealth or increasing taxes on the rich, or any of the pseudo-conservative doomsday prophecies you people spout off whenever someone points out the serious problems when wealth is spread this unevenly in a population.

Bahamut.Milamber Bahamut.Milamber

Server: Bahamut

Game: FFXI

Posts: 3691

By Bahamut.Milamber 2015-05-01 10:57:43

Get the Pope some poor children and a sappy song then watch the money roll in !

Getting some little kids for a Catholic authority figure?

What could possibly go wrong?!

Server: Asura

Game: FFXI

Posts: 34187

By Asura.Kingnobody 2015-05-01 11:34:22

My number is from the SEC, Fortune 500 CEO's. All corporations have a CEO, even very small privately owned corporations. We're not talking about a family bakery, we're talking about publicly traded corporations. Including small business owner/executives is the equivalent of including fake Rolex's in an average price of Rolex's statistic.

And, for the record, your figure is based on voluntary information for ALL corporations, not just publicly traded ones. You are putting a number out there for "shock" value, but it's not an amount anywhere close to reality. You are purposefully excluding about 95% of corporations out there because they don't fit your little narrative. You are cherry picking facts that suits your argument, which is par for the course for a liberal argument.

No, just no. You can't H&R *** canon on this. Most non-executive stock compensation are non-statutory unless they're part of a buying program, executives are almost always given ISO's, which often cannot be exercised for years, so their actual value is taxed as capital gains and not income. You know better. Basically, they're paid a dollar which they cannot spend, it's taxed as a dollar, then 2 years later they can spend it, only now it's 12 dollars, and it's taxed as capital gains. The majority of it's actual value is not considered income. It's a "legitimate" tax code that everyone has access to, except the 99.9% of the population that doesn't get ISO's... So, you don't know anything about ISOs too. Which is not surprising, considering that you never taken a business course in your life.

Most qualified incentive stock option programs limits the amount of options received by an individual up to $100,000, and the number of years between the qualified program receipts. Meaning that the compensation stock received are generally disqualified as ISOs if the options given are over $100,000. These are options where the grant amount and date are compared to the FMV of the stock on that date. So, nearly all options given to executives you are cherry picking in your argument receive non-statutory options as compensation, reportable as income on the year they receive it.

Just in case you don't believe me: Source

If you focus solely on INDIVIDUAL INCOME TAXES, which is why I said it's dishonest. Individual income taxes make up less than 40% of total taxes paid. When compared to the whole, the difference is the top 10% paying roughly 22% of total taxes and the other 90% paying about 18%. Even if we used your graph, why is 90% of the income only responsible for 68% of the taxes? Where in the world do you get your "40% of all federal taxes are from individual income tax" number from? Source please. Although, I highly doubt you can provide one.

I'm not talking about the family farm, I'm talking about investments, which are commonly held abroad by wealthy people. Foreign holdings are treated differently than domestic, especially when their value appreciates. You don't even know how ordinary income is being taxed, or what is being taxed, how in the world do you even comprehend on how foreign holdings are being taxed.

Protip: Individuals pay on worldwide income, not just domestic.

And, once again, I haven't advocated taxing accrued wealth or increasing taxes on the rich, or any of the pseudo-conservative doomsday prophecies you people spout off whenever someone points out the serious problems when wealth is spread this unevenly in a population. That's just income, accrued wealth accounts for another significant chunk of money that isn't being taxed at the same rate on both ends. Read what you wrote again, k?

VIP

Server: Odin

Game: FFXI

Posts: 9534

By Odin.Jassik 2015-05-01 12:32:19

You are putting a number out there for "shock" value, but it's not an amount anywhere close to reality. You are purposefully excluding about 95% of corporations out there because they don't fit your little narrative. You are cherry picking facts that suits your argument, which is par for the course for a liberal argument.

Because ~90% of corporations are closely held and only incorporated for liability reasons, publicly traded corporations are the big boys, the ones that actually matter in this conversations. I'm not making an argument, I'm just pointing out the inconsistencies in the way income and taxes are divided.

Where in the world do you get your "40% of all federal taxes are from individual income tax" number from? Source please. Although, I highly doubt you can provide one.

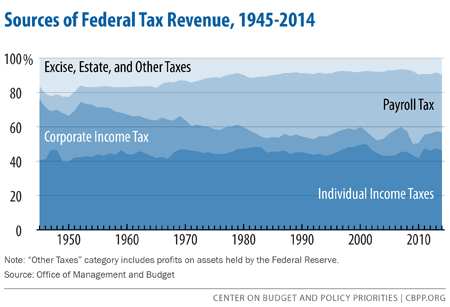

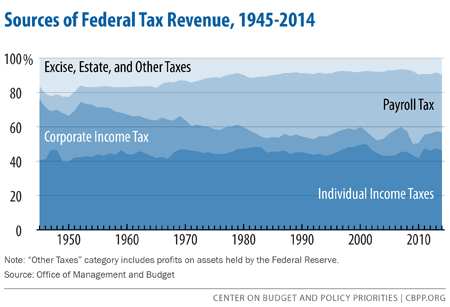

Congressional budget office has breakdowns, here's a nice pretty graph

Quote: Protip: Individuals pay on worldwide income, not just domestic. We're not talking about income, we're talking about capital gains.

I'm done talking to you, you try to bully people around citing random tax codes and spouting accounting babble. You can't even stick to one topic, you just bounce around attempting to talk above people, I'm sure you do it in real life as well. Forever alone.

Server: Asura

Game: FFXI

Posts: 34187

By Asura.Kingnobody 2015-05-01 12:44:49

Because ~90% of corporations are closely held and only incorporated for liability reasons, publicly traded corporations are the big boys, the ones that actually matter in this conversations. I'm not making an argument, I'm just pointing out the inconsistencies in the way income and taxes are divided. Except you were saying all executives average salaries are around $12 million/year. Not "Fortune 500" but all executive salaries. So, you were saying that all small business owners, which comprises of nearly all of the businesses out there, make more in salaries than they do in gross receipts. Which doesn't make sense at all.

Where in the world do you get your "40% of all federal taxes are from individual income tax" number from? Source please. Although, I highly doubt you can provide one.

Congressional budget office has breakdowns, here's a nice pretty graph

Right, and an individual only pays individual income taxes, and payroll taxes just pop out of nowhere in your little world?

But if you want to go that route, the top 50% wealthiest individuals in this nation pays almost all of the individual income tax. They also pay more than 75% of the payroll taxes (mainly because they pay both the employer and employee portion by either as part of their partnership/S-Corp income and also their wages, or self-employment taxes, which captures both sides on the individual level). So, you want to add them together and see how that compares to your cherry picking argument?

We're not talking about income, we're talking about capital gains. Are you saying that only foreign income is taxed at captial gains rate? Shall I prove you wrong again?

I'm done talking to you, you try to bully people around citing random tax codes and spouting accounting babble. You can't even stick to one topic, you just bounce around attempting to talk above people, I'm sure you do it in real life as well. Forever alone. I'm keeping up with whatever you are saying, by providing primary sources as evidence. You are the one bouncing around.

But at least you are admitting that you are wrong by walking away from the argument to save face. Have fun, don't let the door hit you on the way out.

VIP

Server: Odin

Game: FFXI

Posts: 9534

By Odin.Jassik 2015-05-01 13:02:08

Except you were saying all executives average salaries are around $12 million/year. Not "Fortune 500" but all executive salaries.

We were talking about big corporations and I never used the word "all". Keywords for the day "context" and "reading comprehension".

Right, and an individual only pays individual income taxes, and payroll taxes just pop out of nowhere in your little world?

We're talking about SSI budget shortfalls, why the heck would individual income taxes be the only pool to discuss when it's separate from SSI?

Are you saying that only foreign income is taxed at captial gains rate? Shall I prove you wrong again?

Once again, not talking about foreign income, and you know for a fact there are plenty of off-shore places to park capital.

But at least you are admitting that you are wrong by walking away from the argument to save face. Have fun, don't let the door hit you on the way out.

LOOOOOL

Server: Asura

Game: FFXI

Posts: 34187

By Asura.Kingnobody 2015-05-01 13:23:42

Except you were saying all executives average salaries are around $12 million/year. Not "Fortune 500" but all executive salaries.

We were talking about big corporations and I never used the word "all". Keywords for the day "context" and "reading comprehension".

Right, and an individual only pays individual income taxes, and payroll taxes just pop out of nowhere in your little world?

We're talking about SSI budget shortfalls, why the heck would individual income taxes be the only pool to discuss when it's separate from SSI?

Are you saying that only foreign income is taxed at captial gains rate? Shall I prove you wrong again?

Once again, not talking about foreign income, and you know for a fact there are plenty of off-shore places to park capital.

But at least you are admitting that you are wrong by walking away from the argument to save face. Have fun, don't let the door hit you on the way out.

LOOOOOL First off:

You can't even stick to one topic, you just bounce around attempting to talk above people You were the one bouncing around, you just admitted it...

Secondly,

We were talking about big corporations and I never used the word "all". Keywords for the day "context" and "reading comprehension". You said "average" and did not limit that average at all. You said: Here's the rub: Executives average yearly salary is hovering just below 12 million dollars. So, tell the class again where you said anything about a limiting factor in your statement? Come on, we are waiting...

We're talking about SSI budget shortfalls, why the heck would individual income taxes be the only pool to discuss when it's separate from SSI? Who was talking about SSI budget shortfalls? I responded to what you said, and you were going on a tangent. I asked you where you got your number, and you showed that you cherry picked another argument while making an overall broad statement.

Once again, not talking about foreign income, and you know for a fact there are plenty of off-shore places to park capital. I'm talking about investments, which are commonly held abroad by wealthy people. Foreign holdings are treated differently than domestic, especially when their value appreciates. And you are talking about taxable income. You are making it sound like all foreign income is taxed at capital rates. Is that what you are implying? I did ask you that already.....

Valefor.Sehachan Valefor.Sehachan

Server: Valefor

Game: FFXI

Posts: 24219

By Valefor.Sehachan 2015-05-01 13:27:23

I thought we cured you KN. But at least you are admitting that you are wrong by walking away from the argument to save face Many people after arguing for a while might get bored or annoyed and decide it isn't worth their time anymore. It has nothing to do with being right or wrong, just with patience and *** to give.

Server: Asura

Game: FFXI

Posts: 34187

By Asura.Kingnobody 2015-05-01 13:28:42

Well, for somebody who has no *** to give, he certainly giving a ***.

Quote: 'Not to share wealth with poor is to steal': Pope slams capitalism as 'new tyranny'

Pope Francis has taken aim at capitalism as "a new tyranny" and is urging world leaders to step up their efforts against poverty and inequality, saying "thou shall not kill" the economy. Francis calls on rich people to share their wealth.

The existing financial system that fuels the unequal distribution of wealth and violence must be changed, the Pope warned.

"How can it be that it is not a news item when an elderly homeless person dies of exposure, but it is news when the stock market loses two points?" Pope Francis asked an audience at the Vatican.

The global economic crisis, which has gripped much of Europe and America, has the Pope asking how countries can function, or realize their full economic potential, if they are weighed down by the debts of capitalism.

“A new tyranny is thus born, invisible and often virtual, which unilaterally and relentlessly imposes its own laws and rules,” the 84-page document, known as an apostolic exhortation, said.

"To all this we can add widespread corruption and self-serving tax evasion, which has taken on worldwide dimensions. The thirst for power and possessions knows no limits", the pope’s document says.

He goes on to explain that in this system, which tends to devour everything which stands in the way of increased profits, whatever is fragile, like the environment, is defenseless before the interests of a deified market, which has become the only rule we live by.

Shameful wealth

Inequality between the rich and the poor has reached a new threshold, and in his apostolic exhortation to mark the end of the “Year of Faith”, Pope Francis asks for better politicians to heal the scars capitalism made on society.

"Just as the commandment 'Thou shalt not kill' sets a clear limit in order to safeguard the value of human life, today we also have to say 'thou shalt not' to an economy of exclusion and inequality. Such an economy kills," Francis wrote in the document issued Tuesday.

His calls to service go beyond general good Samaritan deeds, as he asks his followers for action “beyond a simple welfare mentality".

"I beg the Lord to grant us more politicians who are genuinely disturbed by the state of society, the people, the lives of the poor,” Francis wrote.

A recent IRS report shows that the wealth of the US’s richest 1 percent has grown by 31 percent, while the rest of the population experienced an income rise of only 1 percent.

The most recent Oxfam data shows that up to 146 million Europeans are at risk of falling into poverty by 2025 and 50 million Americans are currently suffering from severe financial hardship.

"As long as the problems of the poor are not radically resolved by rejecting the absolute autonomy of markets and financial speculation, and by attacking the structural causes of inequality, no solution will be found for the world's problems or, for that matter, to any problems," he wrote.

Named after the medieval saint who chose a life of poverty, Pope Francis has gone beyond general calls for fair work, education, and healthcare.

Newly-elected Pope Francis has stepped up the fight against corrupt capitalism that has hit close to home - he was the first Pope to go after the Vatican bank and openly accused it of fraud and shady offshore tax haven deals.

In October, Pope Francis removed Vatican bank head Cardinal Tarcisio Bertone, after revelations of alleged mafia money laundering and financial impropriety.

Source

|

|